Bitcoin: Over view & devastative impact on economy

Bitcoin is a crypto currency which was created in 2009. Crypto currencies are not legal tender yet Bitcoin has triggered the launch of other virtual coins, Altcoins. — Vinod Johri

Bitcoin is a crypto currency was created in 2009 by mysterious and pseudonymous man alias Satoshi Nakamoto. Transactions are made without middle men & banking channels and operated by a decentralized authority from user to user on the peer-to-peer bitcoin network.

There are no physical bitcoins. Bitcoins are not issued or backed by any banks or governments, nor are individual bitcoins valuable as a commodity. Crypto currencies are not legal tender yet Bitcoin has triggered the launch of hundreds of other virtual currencies collectively referred to as Altcoins.

This digital currency is recorded in a public distributed ledger called a blockchain. Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies, products, and services. University of Cambridge research of 2017 estimates 2.9 to 5.8 million unique users using a crypto currency wallet. Crypto currency has been traded between $5000 (Rs. 3.6 Lakh) to $40,000 (Rs. 29 Lakh) over past year. According to credible information, there are 7 million Indians holding crypto assets of over $ 1 billion.

Network nodes can validate transactions, add them to their copy of the ledger and then broadcast these ledger additions to other nodes. To achieve independent verification of the chain of ownership each network node stores its own copy of the blockchain. At varying intervals of time averaging to every 10 minutes, a new group of accepted transactions, called a block, is created, added to the blockchain, and quickly published to all nodes, without requiring central oversight. This allows bitcoin software to determine when a particular bitcoin was spent, which is needed to prevent double-spending. Blockchain is the only place that bitcoins can be said to exist in the form of unspent outputs of transactions.

Bitcoin has been criticized for its use in illegal transactions, the large amount of electricity used by miners, price volatility, and thefts from exchanges. Some economists, including several Nobel laureates, have characterized it as a speculative bubble at various times. Bitcoin has also been used as an investment, although several regulatory agencies have issued investor alerts about bitcoin.

The US Financial Crimes Enforcement Network (FinCEN) established regulatory guidelines for “decentralized virtual currencies” such as bitcoin, classifying American bitcoin miners who sell their generated bitcoins as Money Service Businesses (MSBs), that are subject to registration or other legal obligations. In May 2013, US authorities seized accounts associated with Mt. Gox after discovering several irregularities. On 23 June 2013, the first time a government agency had seized bitcoin.

Throughout the rest of the first half of 2018, bitcoin’s price fluctuated between $11,480 and $5,848. On 1 July 2018, bitcoin’s price was $6,343. The price on 1 January 2019 was $3,747, down 72% for 2018 and down 81% since the all-time high.

Bitcoin prices were negatively affected by several hacks or thefts from crypto currency exchanges, including thefts from Coincheck in January 2018, Bithumb in June, and Bancor in July. For the first six months of 2018, $761 million worth of crypto currencies was reported stolen from exchanges. Bitcoin’s price was affected even though other crypto currencies were stolen at Coinrail and Bancor as investors worried about the security of crypto currency exchanges.

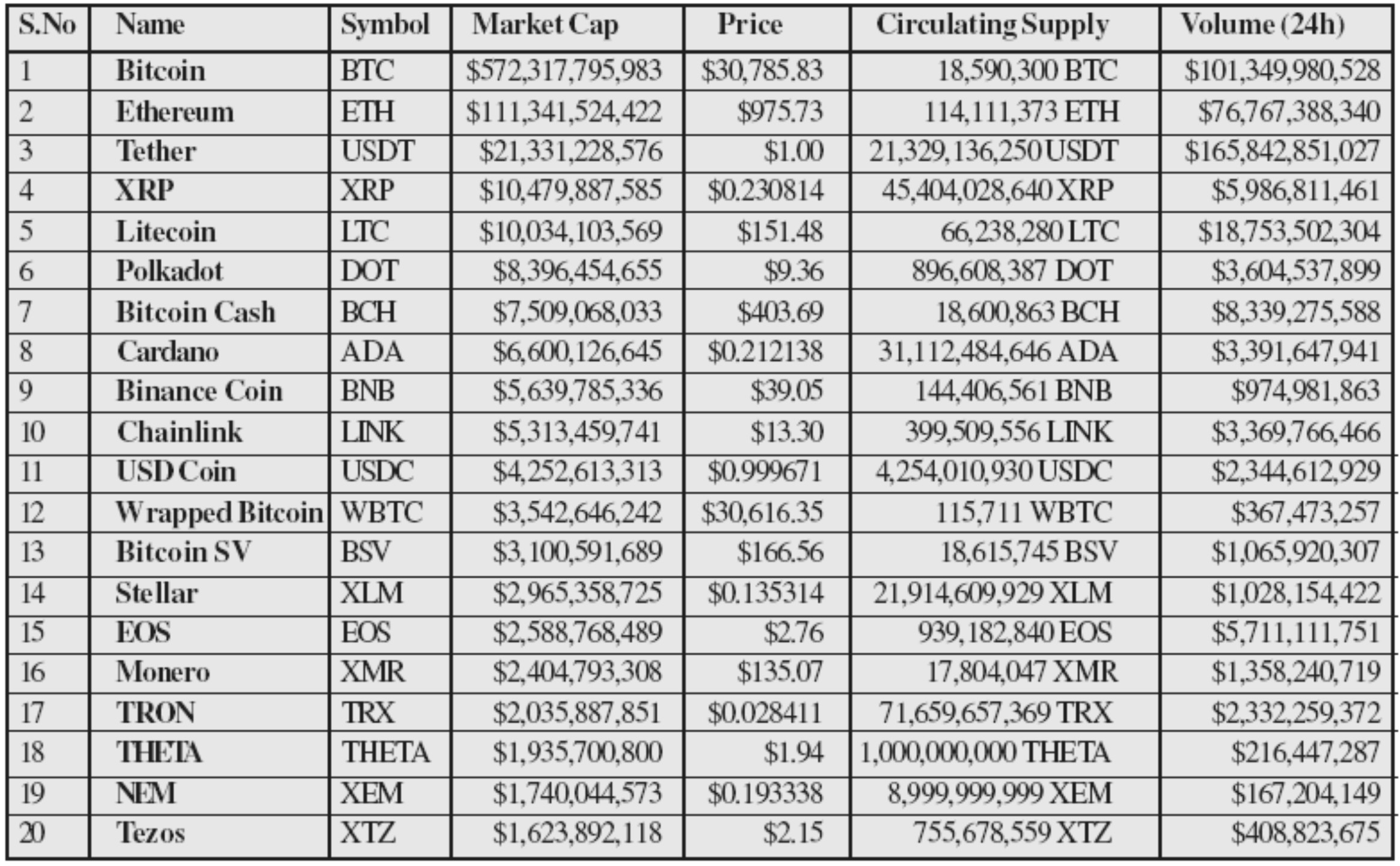

There are more than 400 crypto-currencies in Bitcoin network throughout the world with $ trillions of market cap without any security, identified exchange running Cryptocurrencies. Few details of leading Cryptocurrencies are given table.

Disadvantages

There are disadvantages associated with using Bitcoin -

1. Bitcoins acceptance is very low - Bitcoins are not recognized as valid currency. Most investors have no faith in bitcoins for being highly volatile. Governments shall not recognize it as legal tender.

2. Wallets are not secured – Any technical disruption, hard drive crash, virus attack or data corruption may permanently lose bitcoins. It can’t be recovered.

3. Fluctuating currency - The value of Bitcoins is highly volatile according to demand.

4. No Buyer Protection – The investors and buyers are not protected and transactions are not reversible.

5. Risk of Unknown Technical Flaws – Since crypto currency is very complex technology driven mechanism, technology errors, faults, mischief, fraud, failure, breakdown, crash etc. can destroy the financial worth of buyers or investor and highly enrich the exploiter. Bitcoin is vulnerable to theft through phishing, scamming and hacking. As of December 2017, around 980,000 bitcoins have been stolen from crypto currency exchanges.

6. Built in Deflation - Since each bitcoin will be valued higher with each passing day, the question of when to spend becomes important. This might cause spending surges which will cause the Bitcoin economy to fluctuate very rapidly and unpredictably.

7. No Physical Form - Bitcoins do not have a physical form, it cannot be used in physical stores. It would always have to be converted to other currencies. Huge risk is involved in investing in bitcoins.

8. No Valuation Guarantee - Since there is no central authority governing Bitcoins, no one can guarantee its minimum valuation. If a large group of merchants decide to “dump” Bitcoins and leave the system, its valuation will decrease greatly which will immensely hurt investors .

9. Crime Concerns - Virtual currency and crime are closely connected and untraceable financial transactions facilitate crime. Drug trafficking, prostitution, terrorism, money laundering, tax evasion, and other illegal and subversive activities benefit from the ability to move money in untraceable ways. It has been widely asserted that the popularity of bitcoins facilitated purchase of illegal goods. Nobel-prize winning economist Joseph Stiglitz says that bitcoin’s anonymity encourages money laundering and other crimes. The investors have voiced concerns that bitcoin is a Ponzi scheme vulnerable to fraudulent activities.

Carbon footprint of bitcoins

Non-virtual side of Bitcoin mining in the form of energy consumption has not been given attention. One Bitcoin transaction would generate CO2 equivalent to 706765 swipes of VISA card. Bitcoin’s annual energy consumption is estimated at around 77.8 Terrawat-Hours, up from 9.6 Terrawat-Hours in 2017. It is estimated that half of world’s Bitcoin mining capacity is situated in South West China where power is cheap, less taxed, and supplied by coal fired plants as well as hydro electricity.

Media campaign for crypto-currency

Frequently, the newspapers, youtube channels etc. carry different stories about marketing of bitcoins. About two months before Union budget 2021, fake news of Government taxing Bitcoin transactions at 18% appeared in media frequently, creating a narrative that Govt of India is proposing to give some legal sanctity. It proved totally false.

Recently, Chennai bound news reveals Tesla’s announcement of buying bitcoins worth $1.5 billion and it might accept Bitcoin as payment option. One Mumbai based Bitcoin exchange WazirX is highlighting that it is getting huge deposits up by 300% after Tesla’s decision. WazirX and another exchange CoinSwitch Kuber are promoting Bitcoin business in India. UNOCOIN, another exchange is showing new registrations everyday. Twitter CEO Jack Dorsey & US businessman Shawn Corey Carter are teaming up to form BTrust, an endowment to fund bitcoin development in India and Africa.

Bharat sarkar is bringing Cryptocurrency and Regulation of Official digital Currency Bill 2021 in Parliament. It seeks to prohibit bitcoins with criminal punishment. It has sent bitcoin operators into tizzy. The crypto investors in Bharat may be looking to move their assets elsewhere. The investors in China, Europe, US may be interested in countrywide sell off of crypto assets at depressed prices. Many Indian cryptocurrency exchanges have subsidiaries abroad and in case of probable ban, the investors may move to outside platforms.

There is one more aspect that Cryptocurrency and Regulation of Official digital Currency Bill 2021 should have robust legal provisions which may stand test of judiciary. Crypto dealers claim that crypto assets are not private, therefore, if Govt bans private cryptocurrency, they can continue. Since Courts may intervene, the unambiguous law without any grey area will certainly and effectively put the legislation into implementation. The foremost requirement is unequivocal definition of cryptocurrency.

The fundamental issue is that any unofficial currency running parallel to official currency of a country will certainly cripple the economy of the country and paralyze the Central banking system. The official digital currency of our country will certainly keep us connected & synchronized with global revolution in blockchain technology and digital currencies with better results for our economy.

The author is retired as Additional Commissioner from Income Tax Department, Delhi.